There are three main strategies for warehouse management, FIFO, FEFO and LIFO. For those wondering what the abbreviations actually stand for, read on:

What does FIFO stand for?

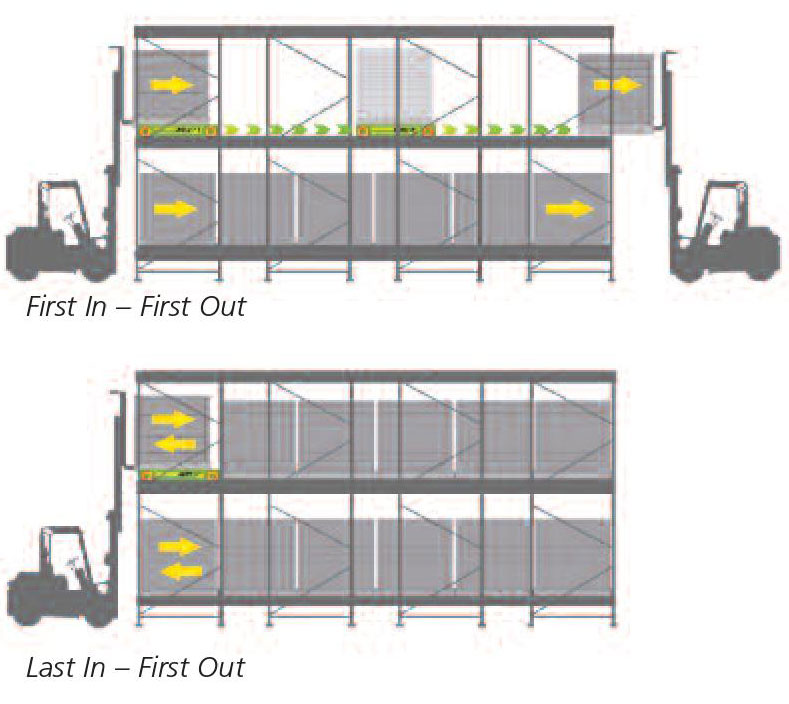

FIFO means “First in First Out”. Products stored first are to be retrieved first.

FIFO, or First-In, First-Out, is an inventory management method where the oldest items in inventory are sold or used first. This means that the cost of goods sold (COGS) is calculated based on the assumption that the oldest inventory items are sold before newer ones. FIFO is commonly used in various industries to manage inventory and financial reporting.

This stock rotation system, also known as inventory rotation, refers to the practice of systematically moving inventory to ensure that older stock is sold or used before newer stock. This helps prevent product spoilage, expiration, or obsolescence by ensuring that items are used or sold in the order they were received. Effective stock rotation is crucial in industries such as retail, food and beverage, and manufacturing to maintain product quality, minimize waste, and optimize inventory turnover.

What does FEFO stand for?

FEFO means “First Expire First Out”. FEFO ensures that products with the shortest expiry date are placed on the market first.

What does LIFO stand for?

LIFO means “Last In First Out”. This principle means that the last goods to be stocked are the first goods to be removed.

Higher Profit through Effective Inventory Accounting with FIFO Method

In the realm of business, maximizing profits is a constant objective. One crucial aspect that plays a significant role in achieving higher profit is efficient inventory accounting. Among the various accounting methods available, the First-In, First-Out (FIFO) method stands out as an advantageous approach for businesses looking to enhance their financial statements and bolster profitability.

One of the key advantages of employing the FIFO method is that it generally results in higher profits, particularly during periods of rising costs or inflation. By selling the oldest inventory items first, the COGS calculation tends to use lower production costs, thereby leaving higher-priced goods in the remaining inventory. As a result, the value of the ending inventory is higher when valued at the most recent or current production costs.

This higher value of the remaining inventory under FIFO has a positive impact on the balance sheet, boosting the overall asset value and reflecting a healthier financial position. A stronger balance sheet often instills confidence in investors and lenders, potentially attracting more investment and better financing options for the business.

Another significant advantage of FIFO is its contribution to better stock rotation. With the oldest products sold first, the risk of inventory obsolescence is minimized, ensuring that goods are moved out efficiently and replaced with newer, more marketable products. This proactive approach to inventory management leads to reduced inventory costs, as the business is less likely to hold onto outdated or slow-moving stock.

Disadvantages of FIFO

Despite its advantages, it is essential to acknowledge some of the disadvantages of FIFO. One drawback is that the FIFO method may result in higher income tax liability during times of increasing costs, as the higher profits lead to higher taxable income. Additionally, in periods of inflation, the FIFO method can overstate the value of the ending inventory on the balance sheet, potentially leading to inaccurate financial analysis.

In contrast to FIFO, the Last-In, First-Out (LIFO) method assumes that the newest inventory items are sold first. LIFO can be beneficial during times of falling costs or deflation, as it offsets the higher production costs against the revenue, resulting in lower COGS and, therefore, higher profits.

Adopting the FIFO method for inventory accounting can lead to higher profits and improved financial statements. By matching revenue with the oldest production costs, businesses can showcase stronger asset values, better stock rotation, and reduced inventory costs. However, it is vital for businesses to consider their specific circumstances and industry dynamics when choosing an accounting method to ensure optimal financial performance.

Ask the experts

If you have a project and would like further advice contact one of our project managers on 01937 585 057 who can help you discuss the options to make your dispatch team faster and more profitable.

Take a look at our Case Studies page so to see some recent projects carried out by team at 2h Storage solutions.